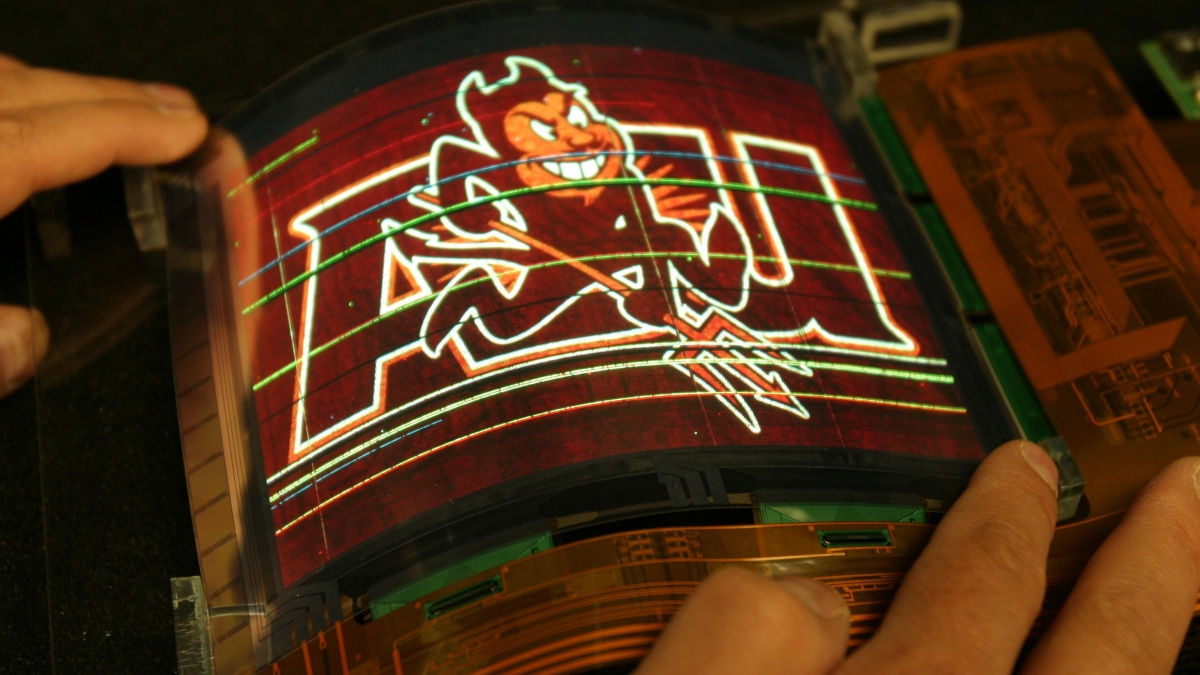

ASU center produces largest flexible color organic light emitting display

The Flexible Display Center at Arizona State University announced that it has successfully manufactured the world’s largest flexible color organic light emitting display (OLED) prototype using advanced mixed oxide thin film transistors (TFTs). Measuring 7.4 diagonal inches, the device was developed at the Flexible Display Center in conjunction with Army Research Labs scientists. It also meets a critical target set by the U.S. Department of Defense to advance the development of full-color, full-motion video flexible OLED displays for use in thin, lightweight, bendable and highly rugged devices.

“This is a significant manufacturing breakthrough for flexible display technology,” said Nick Colaneri, director of the Flexible Display Center. “It provides a realistic path forward for the production of high performance, flexible, full color OLED displays, accelerating commercialization of the technology in the process.”

Mixed oxide TFTs offer a highly cost-effective approach for manufacturing displays that deliver high performance, including vibrant colors, high switching speeds for video and reduced power consumption. Furthermore, mixed oxide TFTs can be manufactured on existing amorphous silicon production lines, eliminating the need for specialized equipment and processing, thereby reducing costs compared to competitive approaches.

“One of the primary directives of the Flexible Display Center has been to pursue approaches to flexible technologies that take advantage of existing manufacturing processes,” continued Colaneri. “This focus drove us to pursue a flexible, color display based on mixed-oxide TFTs, which are widely regarded as a strong, cost-effective alternative to low-temperature polysilicon. This display showcases the Center’s successful scale up to GEN II, and our ability to produce displays using mixed-oxide TFTs in standard process flows with our proprietary bond/de-bond technology.”

The new, full-color OLED display will be on display in the FDC booth #643 at SID Display Week, June 5-7, at the Boston Convention and Exhibition Center in Boston, Mass.

Flexible Display Center at Arizona State University

The Flexible Display Center is a government – industry – academia partnership that’s advancing full-color flexible display technology and fostering development of a manufacturing ecosystem to support the rapidly growing market for flexible electronic devices. The center partners include many of the world’s leading providers of advanced display technology, materials and process equipment. The Flexible Display Center is unique among the U.S. Army’s University centers, having been formed through a 10-year cooperative agreement with Arizona State University in 2004. This adaptable agreement has enabled the Flexible Display Center to create and implement a proven collaborative partnership model with over 26 active industry members, and to successfully deploy world class wafer-scale R&D and GEN-II display-scale pilot production lines for rapid flexible technology development and manufacturing supply chain commercialization. More information on the Flexible Display Center can be found at flexdisplay.asu.edu.